Understanding Obligations under Canadian Tax Rules For International Students In Canada

Photo Credit: https://iescblog.wordpress.com/2015/04/17/income-taxes-in-canada-what-you-need-to-know/

When an international applicant studying in Canada starts earning, maybe it is a part time job or a full one, but it becomes their obligation to pay taxes. On this matter, it is important to know about Canadian tax rules and the residency status which decides how you would be taxed.

These taxes are used towards improvising public and health services.

Determine your Residency Status for Canadian Tax Rules

- If you earn any residential credits i.e. holding any Canadian documents, having your spouse who is a resident of Canada or own a home in the country. You come under Resident

- If you don’t earn enough residential credits and come to Canada for about 183 days or less, you come under Non-Resident

- If you don’t earn enough residential credits and come to Canada for about 183 days or more, you come under Deemed Resident

- If you earn enough residential credits and are resident of the country which has a tax treaty with Canada, you come under Deemed Non-Resident

Why should you file a Tax Return in Canada?

- To claim a refund

- To apply for HST or GST credit

- To transfer any unused funds for education, textbooks or tuition

What do you need to file a tax return in Canada?

- Every international student needs to apply for SIN (Social Insurance Number) to not only file tax returns but also to legally work and obtain benefits from the Canadian

- An alternative to Social Insurance Number is (ITN) Individual tax Number.

- Contact (CIC) Citizenship and Immigration Canada to issue for social insurance number and International Tax Office for ITN.

Canadian Tax Rules to Avail Benefits in the Tax Returns

- Deductions! Deductions can be obtained on the money paid in the form of pension plans, child care, RRSP, professional dues and much

- Non-refundable tax credits: Tax credits are obtained in return of the money already deducted from your salary in the form of

- HST/GST credits: HST/GST credits are rewarded to the applicants with low income in exchange for HST/GST taxes paid while purchasing electronics goods.

- Ontario Trillium Benefit: Benefits for residents of Ontario with low incomes.

- Canada Child Benefit: These are the monthly tax-free benefits paid to the families to help them to raise their children up to the age of 18

Additional Documents to Get Benefits under Canadian Tax Rules

- T4 form: List your incomes, taxes paid and deductions obtain in the last year.

- T4A form: List non-taxable incomes from the previous year i.e. Scholarships.

- T5: To list all the interest received in the previous year.

- T2202A: This form identifies the months you attended college and paid tuition fees in the previous year.

Collect all your tax, medical and rental slips, proofs of usage of public transportation, a blank check or bank account proof, previously filed return and finally prepare your current return file according to current Canadian tax rules and send your parcel to Canada Revenue Agency. Do everything carefully and don’t miss out on any benefits.

Canada Removes Points for Prearranged Job Offers in Express Entry: What It Means for Immigration Applicants

Canada Removes Points for Prearranged Job Offers in Express Entry: What It Means for Immigration Applicants  Express Entry Updates for 2025: What Immigrants Need to Know

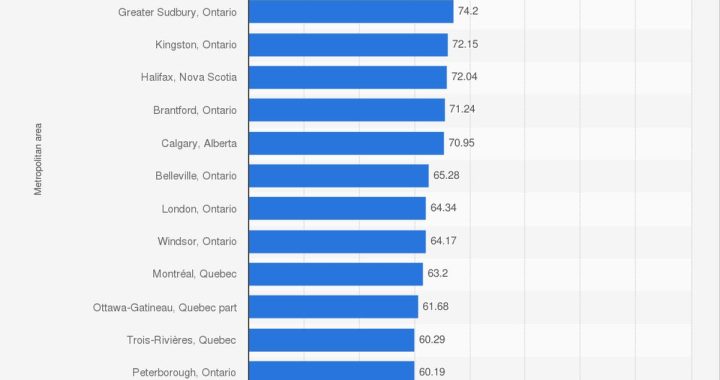

Express Entry Updates for 2025: What Immigrants Need to Know  Navigating Challenges: Canadian Cities, with High Crime Rate, moderate Job Opportunities, Where Immigrants May Struggle to Settle

Navigating Challenges: Canadian Cities, with High Crime Rate, moderate Job Opportunities, Where Immigrants May Struggle to Settle  The Shadowy Trade: Understanding Canadian “Coyotes” for Immigration and Protecting Yourself

The Shadowy Trade: Understanding Canadian “Coyotes” for Immigration and Protecting Yourself  Now Canada Can cancel the Travel Visa or Study Permit issued- What You Need to Know About Visa, Work, and Study Permit Cancellations

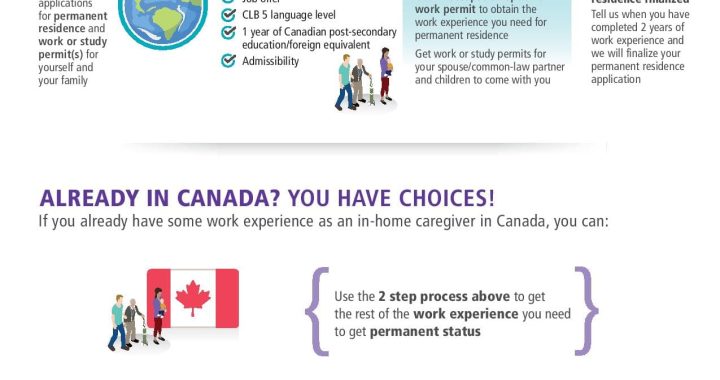

Now Canada Can cancel the Travel Visa or Study Permit issued- What You Need to Know About Visa, Work, and Study Permit Cancellations  New Education Assessment Requirement for Caregivers: A Major Setback for Immigration to Canada

New Education Assessment Requirement for Caregivers: A Major Setback for Immigration to Canada  ICE Deportations at Immigration Hearings: Truth, Risks & Legal Remedies

ICE Deportations at Immigration Hearings: Truth, Risks & Legal Remedies  What happens if the marriage ends before the conditional green card is granted to spouse

What happens if the marriage ends before the conditional green card is granted to spouse