Ford readies downsizing

Washington–The recurring cost and competition had led many big comapny downsize their staff strength, since this is the only option if the company wants to remain in the markets. Almost exactly four years ago, Bill Ford Jr. took over Ford Motor Co. and promised a painful downsizing of the company founded by his great-grandfather.

On Thursday, as the automaker posted its first quarterly loss since 2003, Bill Ford once again vowed harsh measures to preserve the future of Ford and his own family legacy.

“We need a dramatically different business structure,” Chairman and CEO Bill Ford said during a conference with analysts and reporters.

He plans to detail a major restructuring in January to revive Ford’s money-losing North American automotive operations.

The automaker plans “significant” plant closures and other cost-cutting moves. Industry analysts say 20,000 or more blue-collar jobs are likely to be cut.

“Our industry is beginning a dramatic restructuring that is sorely needed,” Bill Ford said. “And change is often uncomfortable and the consequences will be painful to some.”

The sobering news at Ford comes against the backdrop of the growing crisis emerging in Detroit’s auto industry. Rival General Motors Corp. reported a $1.6 billion third-quarter loss earlier this week and Delphi Corp. recently filed for Chapter 11 bankruptcy protection.

Ford’s third-quarter performance did nothing to bolster confidence in the automaker.

Ford lost $284 million in the quarter, a drop of $550 million from the same period last year. Its struggling North American operations fared even worse, posting a pretax loss of $1.2 billion, compared with a loss of $481 million for the third quarter of 2004. Worldwide, Ford’s automotive business reported a pretax loss of $1.3 billion, compared to a loss of $609 million a year ago.

Revenues rose 4.4 percent to $40.9 billion from $39.1 billion.

Rising gasoline prices have decimated the once-lucrative market for sport utility vehicles and trucks, and skyrocketing raw material and health care costs have eroded Ford’s profits.

Ford’s results would have been even worse if not for a $240 million settlement with Bridgestone Firestone over the infamous 2000 tire recall.

Bill Ford’s call to action was expected, but observers were struck by the urgency of his message.

“What this really says is that major surgery is required,” said David Cole, chairman of the Center for Automotive Research. “Doing nothing is not an option. It’s change or die.”

While GM announced additional restructuring moves, Bill Ford said he wanted to give the company’s new management team time to develop their own solution — one that he said will realign the company’s manufacturing operations to match current market realties.

Mark Fields, president of Ford’s Americas operation, and Anne Stevens, his chief operating officer, will work out the details of restructuring and make recommendations to Bill Ford by December. The restructuring will be announced in January.

“That plan will include significant plant closings,” Bill Ford said. But, he added, “this is not a sacrifice that we will ask only the UAW and its membership to bear. There will be sacrifices asked of people throughout our company — from top to bottom.”

Some analysts, like Rod Lache with Deutsche Bank Equity Research, were disappointed Ford didn’t reveal more of its plans.

“Ford’s North American operating business model continues to deteriorate,” Lache said.

Cole said Bill Ford wants to give his new leadership team a chance to help shape the company’s turnaround plans.

“Bill Ford’s philosophy is that he wants a team at the top of the pyramid,” Cole said.

Ford is negotiating with the United Auto Workers to reduce health care costs. The talks have gained momentum with a tentative deal between GM and the union.

“We want to wait for the GM deal to get ratified,” Ford said, “so we are not saying a lot.”

Unlike GM, which is looking for a strategic partner to take control of its financing arm, Ford said its fiance arm, Ford Credit, remains an important part of its business.

Ford is also trying to respond more quickly to consumer demand for more fuel-efficient vehicles.

“While this shift is something we anticipated, the future arrived faster than we expected because of this year’s sharp spike in fuel prices,” Ford said.

Ford is marketing two hybrid SUVs and plans additional hybrid car models.

Despite its poor performance, Ford’s balance sheet still looks better than GM’s. Ford has made $1.9 billion in net income since January. So far, GM has lost $3.8 billion. Ford ended the third quarter with $19.6 billion in cash and $18.2 billion in debt. GM’s debt exceeded its cash on hand by more than $13 billion.

“It was a tough quarter — no question,” Ford chief financial officer Don Leclair told The Detroit News in an interview. “But we have a plan to rectify this.”

It is a plan whose implementation Bill Ford promised to see through personally.

“We can, and will, dramatically change the structure and the focus of our business. And, lest there be the slightest doubt, I will be in charge of this effort, without any reluctance whatsoever.”

Get To Know Everything About Canadian Experience Class immigration

Get To Know Everything About Canadian Experience Class immigration  How To Find Perfect Professional Contacts For Getting Jobs in Canada?

How To Find Perfect Professional Contacts For Getting Jobs in Canada?  You can’t miss this News, if Eyeing for Canadian Permanent Residency

You can’t miss this News, if Eyeing for Canadian Permanent Residency  A Canadian Woman was Detained by U.S. Border Guards for 5 hours!

A Canadian Woman was Detained by U.S. Border Guards for 5 hours!  Canadian Trucking Alliance Calls the Canadian Government to safeguard the immigrant Truck Drivers Rights

Canadian Trucking Alliance Calls the Canadian Government to safeguard the immigrant Truck Drivers Rights  What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

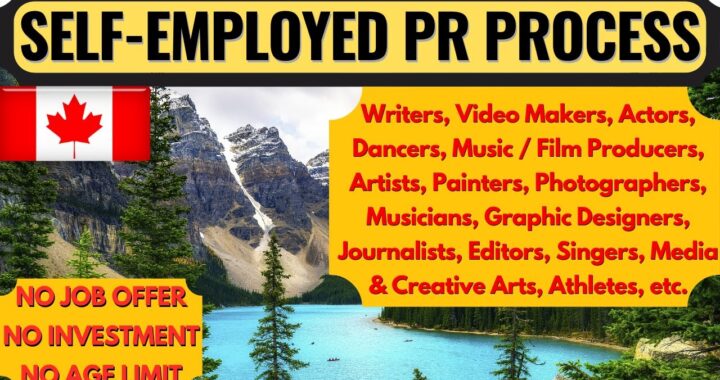

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?