How a CA from India can apply for Job in Canada and what are Prevailing Salaries

Salary as Chartered Accountant in Canada

Similar to CAs in India, Chartered Professional Accountants are designated accountants in Canada. Read through here the method and how a Chartered Accountant in India can apply for Immigration to Canada.

This is the federal national immigration stream and works on the Comprehensive Ranking System (CRS). This system assesses and points out your attributes, such as age, academic qualifications, work experience, language skills, valid employment offers and so forth. Based on the points given, if you are eligible, you may be considered for immigration to Canada. While various ways to immigrate to Canada; Federal Skilled Worker Program (FSWP) is one of the most popular.

What are the Prospects of Chartered Accountants Immigrating to Canada?

This immigration option of immigrating in FSWP is intended for those skilled people who desire to migrate into and work in Canada. It would help if you had at least a Bachelor’s degree and one year of work experience to do so. You also need a good IELTS score that demonstrates that your English skills are good enough to meet the eligibility criteria for immigrating to Canada. Generally, to have the cut off point, minimum IELTS score of 8.5 is desirable

To rank high in CRS and get ITA(invitation to Apply) for immigrating to Canada, a job work offer from a Canadian business will be additional advantage

Immigrating to On Demand Occupation Stream

The on-demand occupation stream is appropriate for people who want to migrate to Canada without a job offer. You can apply only if your job is in great demand in Canada. It will be good idea to check the NOC list for which the provinces and then choose the province that have the highest demand for Chartered Accountancy professionals. This shall make your immigration approval much faster.

To be selected for immigration through this stream, you will also need proof of funds to substantiate that you have enough funds for you and your family to sustain in Canada for at least three months.

Program for Provincial Appointments (PNP).

Each Canadian province has its immigration scheme to offer. These programs are intended for persons who generally do not want to enter Canada through the Express Entry program. One significant advantage of this immigration option is that the qualifications for selection are lower than the national express entrance program.

Why a Chartered Accountant should Immigrate to Canada?

- Canada is among the world’s most liberal nations.

- It has a vast immigrant population, and Indian immigrants comprise a huge segment.

- By 2021, Canada proposes to accept more than 1,000,000 new immigrants.

- The immigration process of Canada is efficient and straightforward and does not demand money until you are asked to apply.

- Even if you have the required skills and working experience, you can move to Canada without a job.

- Canada has a flourishing economy that provides talented workers with many attractive career opportunities.

- Canada offers newcomers the opportunity from the outset to become permanent residents.

- As a PR, you can enjoy several perks, including free schooling for your children and free family healthcare.

- Canada boasts one of the world’s most advanced systems of education.

- After only three years of living, you can become a full Canadian citizen.

Also Read- Quality of life immigrating to Halifax, Canada

How to get membership of accounting body in Canada

-

Who are CPAs?

CPAs are professional accountants working in the field, trade, finance, government and public practice. They are nationally and regionally represented through CPA Canada and their provincial/territorial/regional associations and local chapters.

-

Entity regulating CPA.

The Canadian Certified Public Accountants Association has 55.000 Certified Public Accountants and students as national self-regulators. CPA is active in Canada and abroad; students are enrolled in Canada, Bermuda, the Caribbean, Hong Kong, and the People’s Republic of China’s professional education CPA program.

-

How to register for CGA Canada.

For people resident in Canada, they may register for the CGA Program through the provincial affiliates and at the time of application, every application is subject to the affiliate policies. You must also be either an immigrant or a citizen who has landed or have a valid student visa. For those registering under distance learning program, one must reside in the jurisdiction of one of the provincial affiliates or international examination centres.

How to apply for accreditation in Canada

CICA is responsible for the structure of the profession of chartered accounting in Canada. The Canadian CA designation allows a person to exercise public accounting in Canada. Certified General Accountants (CGAs) are professional accountants who are members of the Certified General Accountants Association who have acquired their accounting education. Certified management accountants (CMAs) are experts of strategic financial management who integrate accounting competence and business abilities with professional management to give leadership, creativity and an integrative approach to company decision making.

A Chartered Accountant immigrating to Canada can also explore acquiring CPA, CMA qualification and would get exemption in some papers

Education and Examination

As per the agreement ICAI has with professional bodies in Canada, ICAI members obtaining their Canadian CPA designation are Exempt from all CPA PEP modules, but advised to do Capstone 1 and Capstone 2 Capstone (completion of these modules is not mandatory)

Experience

Evaluation of certification experience is determined by post-qualification experience as a member of ICAI. With all members:

- More extended than five years of post-qualification experience and no academic degree are free from evaluation.

- More than two years of postgraduate and recognized degree experience are exempt from the evaluation of the experience.

- Applicants with less than required post-qualification experience will be subject to a pre-and post-qualification review of their experience.

- All relevant experience as a member or student of the Indian Chartered Accountants Institute must have been achieved.

Additional requirements

To be recognized as a CPA designate with CPA Canada after initial admission, you must:

- a) Retain ICAI membership;

- b) Fulfil the CPD obligations of CPA Canada and ICAI

How to apply for CPA Canada registration

The registration method differs based on several provincial bodies in which the member wants to follow the same approach. All candidates must pass through a local body. Members can access the website URL of CPA Canada for information and contacts in provincial bodies.

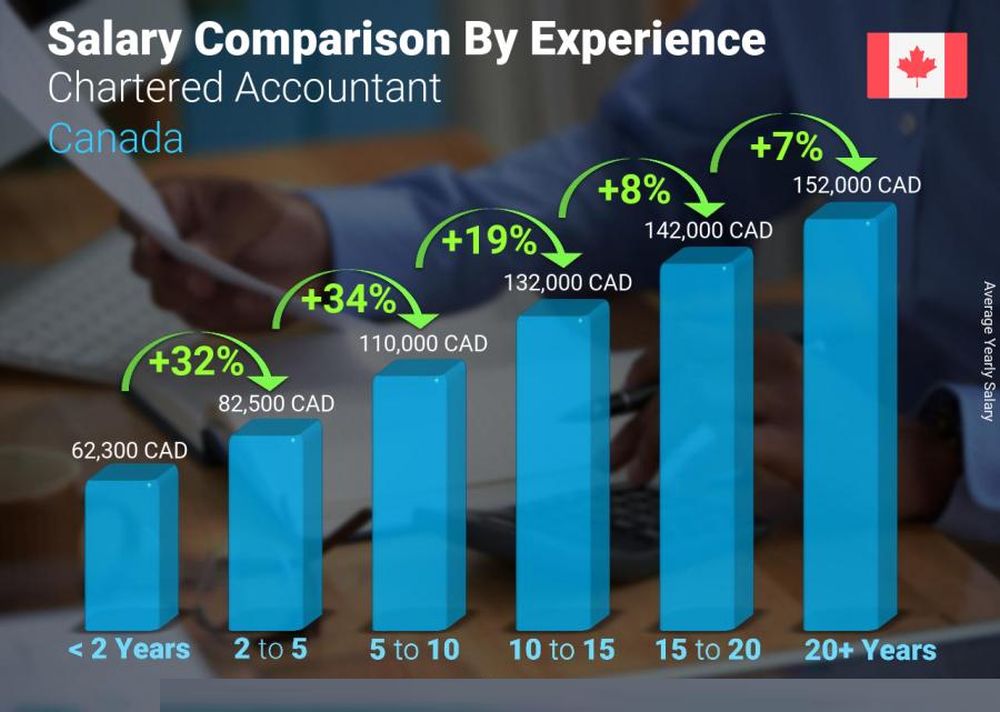

What are the Salary levels of Chartered Accountants in Canada?

The average Canadian chartered accountant wage is $62,450 per year or $32,03 per hour. The entry-level begins at $53,021 annually, while most experienced employees account for $90,125 annually.

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?  Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs

Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs  Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries

Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries  Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination

Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination  H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand

H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes