How to Tackle Canada’s Increasing Costs of Living as a Newcomer?

Increased Cost of Living Canada

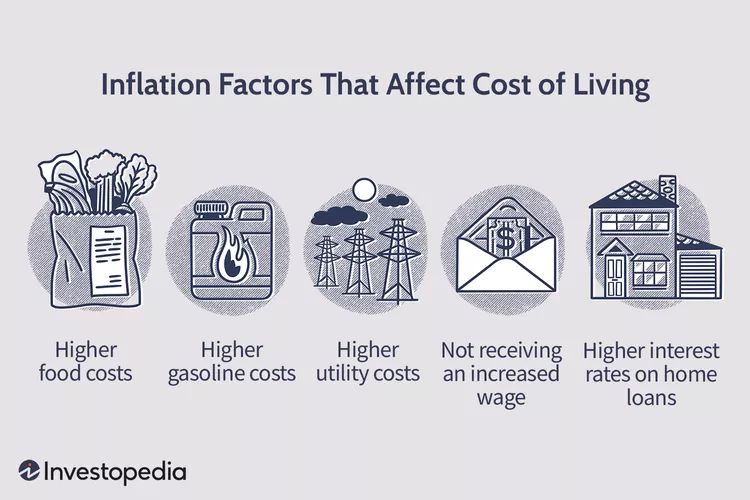

Canada is witnessing a hike in the cost of living and other expenses, along with the high-interest rates when borrowing money for various purposes. Moreover, a recent survey revealed that 56% of Canadians are reducing their extra expenses and moving on from popular brand products, focusing more on basic needs.

Under such circumstances, newcomers find settling into the country difficult. However, immigrants looking for loans to pay for their education, certification, or other professional training courses can get help from Windmill Microlending.

Cost of Living your dreams in Canada

Eligibility norms for availing loans from Microlending Canada

To qualify for a loan from Windmill Microlending, you must be an immigrant with permanent resident status, Province Nominee, Canadian Citizen, or Temporary Foreign Worker with an open work permit. On the other hand, these loans are unavailable for an international student, live-in caregiver, or refugee claimant.

Cost of Studying and Living in Canada

Windmill Microlending Client Success Coach Joyce Wan is eager to help newcomers follow their career trajectory without getting burdened by the increasing costs of living in the country. According to Wan, the main tip to finding financial stability as a newcomer is to calculate and emphasize one’s saving goals, be it buying a car or house or attending a professional training course. In that case, newcomers can also utilize Windmill’s fixed-interest rate loans and borrow up to $15,000 to upskill themselves and aim for high-paying positions.

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes  Recent Changes to Canada’s Temporary Foreign Worker Program (TFWP) Effective May 1, 2024

Recent Changes to Canada’s Temporary Foreign Worker Program (TFWP) Effective May 1, 2024  Immigration Process to Latvia and Job Prospects

Immigration Process to Latvia and Job Prospects  Notario Fraud- a rampant fraudulent practice trapping immigrants to US and Canada

Notario Fraud- a rampant fraudulent practice trapping immigrants to US and Canada  Canada Immigrant Investor Program 2024- loaded with many good features- Check out here

Canada Immigrant Investor Program 2024- loaded with many good features- Check out here  What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?