Essentials of Canada Child Benefit Plan

Essentials of Canada Child Benefit Plan

Canada is well-known for the obliging schemes and plans of the Government for promoting citizen welfare. Child Benefit Plan of the Government in one such step. Canada Child Benefit (CCB) aids the parents in raising children below the age of 18. Canadian Revenue Agency (CRA) is the administrative body of the child benefit plan. CRA is responsible for the collection of taxes and distribution of the benefits among its citizen. The primary aim of the CCB is offsetting a portion of the total cost required in raising a child. This scheme can be availed by the residents of Canada as well as those who just landed in the country and have a kid under the age of 18. Here are some of the common things you would like to know before immigrating to Canada.

What do I need to know about Canada Child Benefit Plan (CCB)?

The child benefit allowance lightens the financial stress of families raising a child to the age of 18. The Canada Child Benefit may also incorporate Child Disability Benefit (CDB). The government of Canada devised CDB to financially help the caregivers to raise a child with long-term mental or physical impairment. Keeping in mind the low-income group sections of the country, the Government came up with the National Child Benefit Supplement (NCBS) which became an extra hand of the CCB.

The next big question, who can avail the Canada Child Tax Benefit.

Also Read- Cities in Canada where new Immigrants can land a Job faster

Who is Eligible to get CCB?

There are four vital criteria one needs to meet for availing of the Canada Child Tax Benefit.

- The child/children must be living in their parents’ residence and must be under the age of 18.

- ONLY the primary caregivers of the child/children can apply for the benefit.

- One must be a resident of the country. In the case of immigrants, they have to confirm their permanent residence before applying for CCB.

- For immigrants willing to avail of CCB, either their spouse or common-law partner must be a citizen of the country.

A permanent resident, a protected person, or a temporary resident living in the country for the last 18 months may also apply for the child benefit plan provided they meet the other highlighted criteria.

When to apply for the Canada Child Benefit plan?

As per the provided criteria, anyone can apply for the scheme having a child below the age of 18, living in one’s residence, provided the caregivers meet the eligibility criteria. So, you can apply as soon as the birth of your child! The government included special cases like child custody and encourage parents to avail of the scheme even if they have children part-time. The CRA reviews the entitlement of the applicants every July based upon the previous year’s net income of the family/individual.

How to apply for CCB?

The application for Canada Child Tax Benefit can be done online with the Automated Benefits Application website of the Government. The required information for the ABA services is provided by the province in the provincial or territorial birth registration pack. the 4 essential requirements for the application are:

- Proof of citizenship or immigrant status in the country.

- A bank statement or utility bill that works as evidence of your residence in Canada.

- Birth proof of child/children.

- Proof that one is the primary caregiver of the child/children.

The CCTB was formulated to ensure no child is being raised in poverty and is getting the fundamental aid in their development.

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

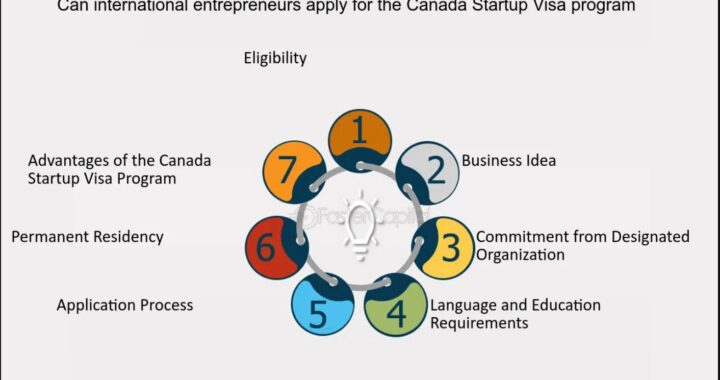

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?  Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs

Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs  Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries

Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries  Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination

Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination  H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand

H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes