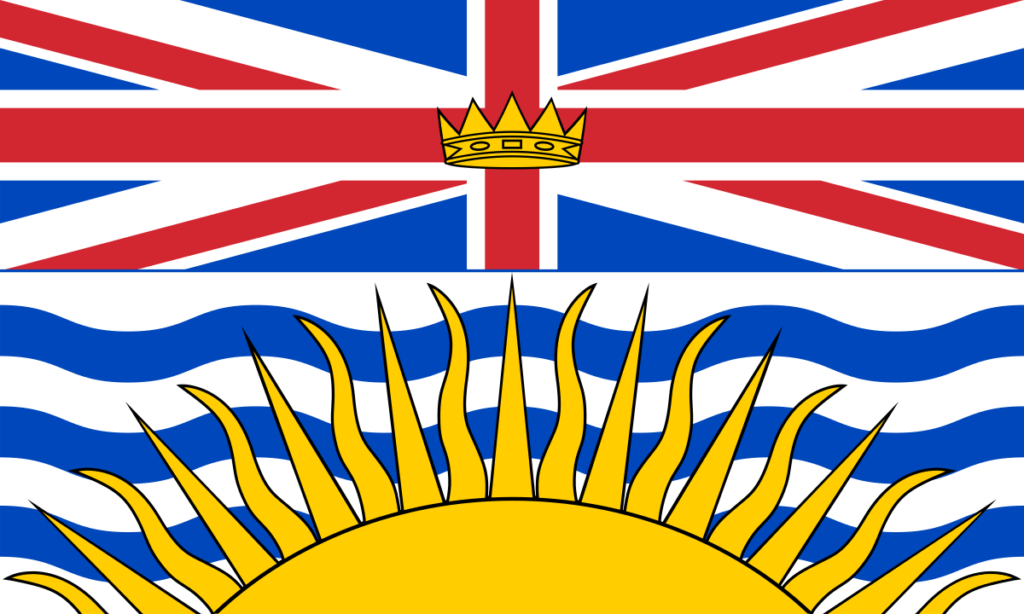

For starting a business in British Columbia it is not necessary for you to be a Canadian. But yes, the rules and regulations are different for starting a business for a non-Canadian as compared to the citizen of Canada. Fron March 29, 2004, onwards, non-residents can also start their business in the country. but they do need to follow certain guidelines and official regulations.

Things You Need To Know For Starting Business in British Columbia as Non-Canadian

The rules and regulations for starting a business in Canada for a non-Canadian change from one province to the other. So if a certain thing is acceptable in Saskatchewan, it may not be applicable for doing business in B.C. For example, in some states having a post office box is enough to initiate a venture. But in British Columbia, you are required to have a complete postal address and must fulfill certain legal formalities. Checking out with the BC Corporate Registry is the best way to get complete information on such necessary formalities.

Obtaining a work permit and status is the next step for starting a business as a non-Canadian. You can apply for business immigrant status which is the best option as it allows you to start a business in the country as well as live there. Here you have two options. Either to apply through a start-up visa program or through a program for self-employed people/entrepreneurs.

Students interested in starting their business in Canada while they are pursuing their studies should apply to CIC and obtain a modified study permit. While this permit allows you to study as well as do business in the country it does not make you a Canadian citizen.

Also read- Comprehensive Guide for Moving to Canada

Government Offices in Canada You Need to Contact for setting up Business

As a non-Canadian when you start a business in Canada, over time you will start earning revenue and will be liable to pay the tax. For that, you will need a business number which you can get by contacting Canada Revenue Agency. Using this business number you can start filing tax returns. In the case, your annual revenue goes above $30,000 then you will also have to obtain an HST number.

The next step is to intimate the Canadian government that you are starting a business in Canada. For that, you must visit Investment Canada and initiate the business formalities. All these formalities can be easily fulfilled online.

In the case you are starting a business in partnership, then it is mandatory that the other person in the partnership is a Canadian. If there are multiple partners in your business at least some share of the business should be owned by a Canadian citizen.