How Much Income is Needed in Order to Sponsor your Parents to Canada?

How Much Income is Needed in Order to Sponsor your Parents to Canada?

Before one can think about bringing their parents to Canada they should think about ‘ how much income is needed in order to Sponsor your Parents to Canada?’

Once you get the chance to become a sponsor, then you must provide satisfactorily enough income that means you should be financially comfortable or stable so that you can provide support to your parents including yourself.

In case if you are eligible to apply for the same, then you should provide reasonable proof about your income which will fulfill the requirement of taxation for every three years.

Significant dates to sponsor your parents to Canada

It is more important that we should provide more focus on the date of filling applications form. And it is very much clear that filling a date means the date at which your starting application of sponsorship enters into the immigration office. (9 June 2020).

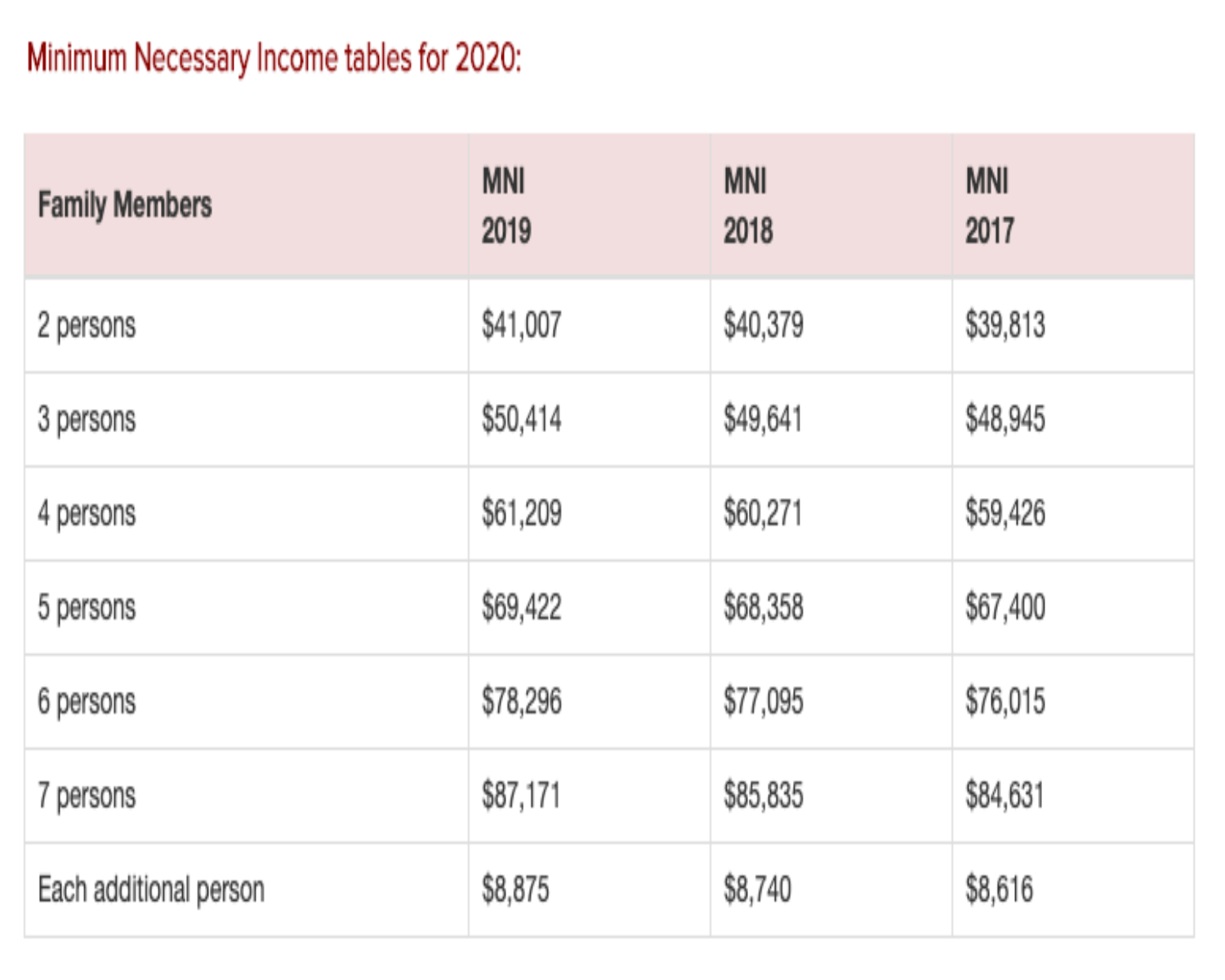

The permanent citizen of Canada ( sponsor ) must gratify some regulation that is related to the basic income of that particular person. It simply means that once the sponsor submits the filling date then his income should satisfy the minimum essential income for at least the previous three years. For example, if a sponsor fills the date in 2020 then under the given condition, his previous three-year income is considered like 2017, 2018 & 2019.

The income of a co-signer for sponsoring parents

There is a facility provided for sponsors spouse, that she can also co-sign the application, it simply means that you eligible to add the income of your both together, but at the same, you are not allowed to add the income of another family member, hence other family members are not allowed to co-sign. In this case income of parents is not taken into consideration.

Origin of data about income for sponsoring parents

It is more important to give more preference for verified data of income which is considered as Notice of assessment under Canada revenue agency (CRA). Similarly, you can choose the printout of alternative c delivered by CRA. In order to identify the associated income, you can have a look at the line of 150 under NOA.

The income of the previous year for sponsoring parents

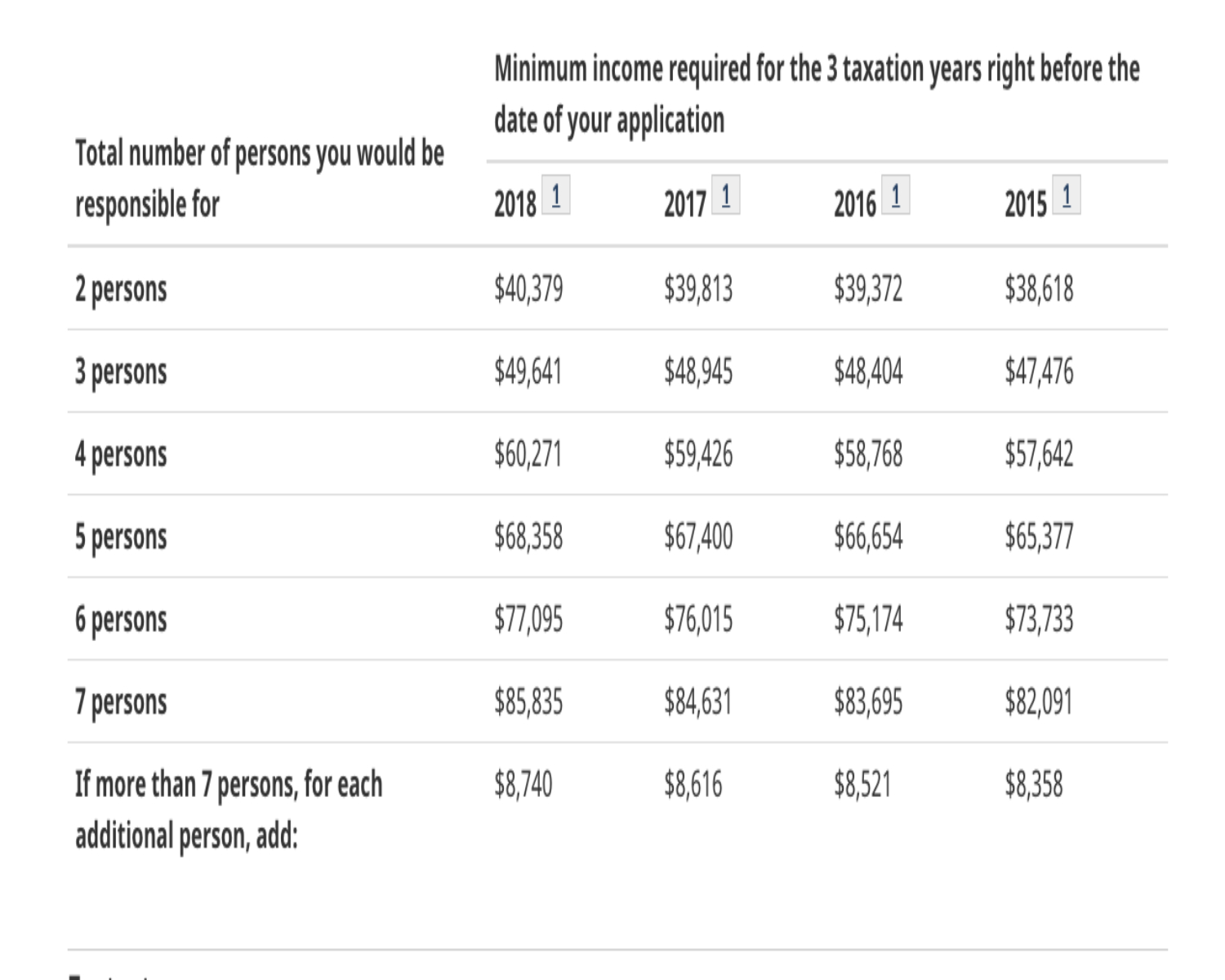

If the sponsor is applying for it in January 2020, then in such a case the year of 2019 is considered under the notice of assessment( NOA). Hence sponsors may depend on previous year income like 2018, 2017, and 2016. However, according to operational bullets associated with IRCC, the officer may calculate his income in the recommended way.

Income and family stature for sponsoring parents

The family stature of the particular sponsor is contemplated as a vital part of the minimum necessary income. For example, the sponsor is living alone with his mother in his family and he is sponsoring his mother then in that case number is taken as 2. Take another example in which the sponsor is living with both his mother and father including his wife and children and he and his wife sponsoring their mother and father then in such case number is considered as 6.

To support family members, the sponsor must go beyond the level of minimum necessary income.

There is a requirement from the sponsor side that he should provide well established financial support to his family members in order to bring them to Canada.

According to Canadian provinces, two factors are considered an important part like where the sponsor lives and how many members he has in his family? in which minimum necessary income may vary according to a number of members in the family.

Also Read- If you thought that getting Super Visa for parents and grand parents to Canada was a difficult task, you may want to think again.

For all regions prohibiting only Quebec

In order to qualify for sponsorship support to your grandparents or family members, the sponsor must go beyond the minimum necessary income for consecutive three years. For example, if the sponsor is applying in the year 2020, then must exceed his minimum necessary income for the previous three years like 2017,2018, and 2019. There should not be any mismatch of the minimum necessary income for the year with each year of income.

Important note: As there is a delay in the return of processing tax, matching of the minimum necessary income with actual year income should always be done on the basis of number by considering previous year income of the actual year.

If the sponsor wants to be eligible for sponsoring all other family members excluding parents and grandparents, then in such a case, one previous year’s income of the sponsor must exceed the minimum necessary income of the previous year. It simply means that the sponsor did not have to exceed his minimum necessary income for consecutive 3 years, he can overstep his minimum necessary income for the most recent year only.

The minimum necessary income is calculated on the basis of lower-income cut-off plus 30%plus. Use of Quebec minimum necessary income for applying the year 2020. Sponsors who are living on the basis of Quebec must attain the different bunches minimum necessary income.

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?  Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs

Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs  Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries

Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries  Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination

Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination  H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand

H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes