How to Grow Your Money in Canada?

How to Grow Your Money in Canada?

There is no dearth of opportunities in Canada from a career point of view. It is due to the fact that the country offers immense freedom and opportunities to migrants.

Just in case you are new to the country and wish to complete some ongoing project or plan your retirement, you need to be well aware of some of the viable alternatives. Such type of investment options will surely help in the growth of your hard-earned money in Canada.

You need to keep in mind your specific needs and investor profile before opting for an investment vehicle. Read on to get to know more about such alternatives.

Investments that are Principal-Protected:

You need to pay attention to the fact that these will help in the protection of your monetary interests even when the stock markets are fluctuating. Some of the examples are GIC or guaranteed investment certificates at a workable or fixed rate of return.

Mutual Funds:

In this case, the return is not completely guaranteed. Just in case you are interested in getting a better return out of your investments and do not hesitate in taking risks, mutual funds are great for you. It is still considered safer than buying company shares directly on the stock market.

ETF or Exchange Traded Funds:

These include several companies’ securities traded on the stock market. ETFs usually duplicate a meticulous index or pursue another monetary asset or a currency. But two characteristic features like the lower management cost involved and the way they are traded, differentiate EFTs from mutual funds.

RRSP: Retirement Oriented Saving

RRSP or Registered Retirement Savings Plan is basically a saving plan which is government-registered. The entire focus is on building retirement savings. And this is done by lowering the income taxes.

TFSA: More about It

With the help of Tax-Free Savings Account, you get the perfect opportunity to shelter as well as save the asset income from taxes. This will not depend on your annual income. You will be able to make contributions every year (within a yearly limit) set by the Government of Canada.

Role Played by Financial Planner:

It is a smart idea to opt for professional help which can help in getting an insight into the Canadian investment solutions and products. The financial planner will offer all the support and guidance necessary for managing all your finances in the right manner and in the right direction.

So power your ideas with the help of the financial planner.

The experts will carry out a detailed study of your financial situation and offer appropriate solutions.

Why Should You Save?

It is important that you save for the future so that you do not have to think twice before buying a property or take a trip. It basically means that you are preparing yourself for the future. This way you will be able to deal with all the challenges of life with zeal.

Safeguard the interests of your loved ones by saving today.

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

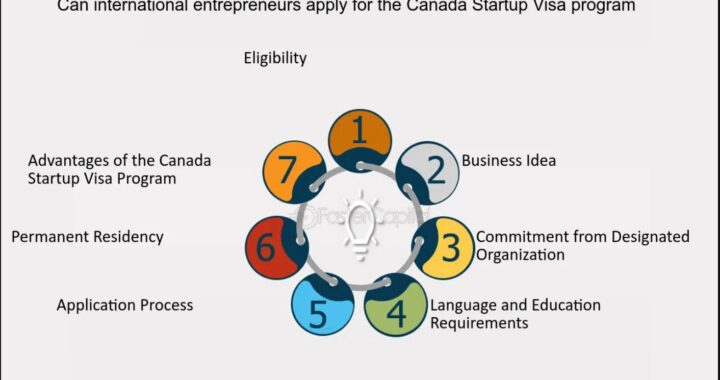

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?  Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs

Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs  Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries

Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries  Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination

Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination  H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand

H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes