How can A person Work as a Business Visitor in Canada

How can A person Work as a Business Visitor in Canada

There have been some recent conversations related to the option of moving to Canada as Business Visitors. As a visitor, a person can stay without a visa in Canada for six months. However, they cannot work in the country. A lot of Business Visitors entering Canada need not have a Work Permit, and they have to provide validation that the primary place of business, as well as the primary income source, isn’t in Canada.

There are numerous reasons why Business visitors move to Canada:

– Education

– Professional meetings

– Exploring new opportunities for business in Canada

– Visiting offices that are Canada-based

According to Evelyn Ackah, who is a Canadian immigration lawyer, foreign workers must not be sent by employers into the US or Canada without having the NAFTA business visitor document, which confirms their activity as a business visitor if they face any kind of confrontation at the border. In case they are not permitted, it could have an impact on their ability to enter the US or Canada for personal/tourist reasons.

Who is a Business Visitor as per Canadian Visa Laws?

According to the IRCC, which controls the rules and regulations of immigration of the Canadian government, a Business Visitor is a person who visits Canada in relation to any Trade agreement, representative of a foreign business established in Canada or a Person who is travelling to Canada in pursuit of any business deal or agreement:

– for foreign business activities

– and does not enter the labor market of Canada directly.

A person would require the temporary resident visa or the electronic travel authorization to move into Canada as a business visitor, and providing biometrics is a must. There are specific requirements of the IRCC which must be met for entry as a business visitor, and you have to show that

– you intend to stay for six months or less

– you have no plans of entering the labor market in Canada

– your primary place of business, as well as the source of profit and income, is not in Canada

– you have all the documents to support your application

– you meet the standard entry requirements of Canada

– you have valid travel documents like passport

– you have sufficient money to stay in Canada and return home

– you intend to leave Canada to post your visit

– you are no criminal and do not pose a health or security risk to the Canadians

Based on the country of origin of the person, the professional activities of a business visitor are restricted.

Also read- Canada Business Visitor Rules

Taxes in Canada for Non residents in Canada

Canadian Non-residents who reside for more than 183 days a year (above six months) could be considered as residents and are liable to tax on the worldwide income. People who reside in Canada for less than six months might be considered to be residents for taxes based on income sources.

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

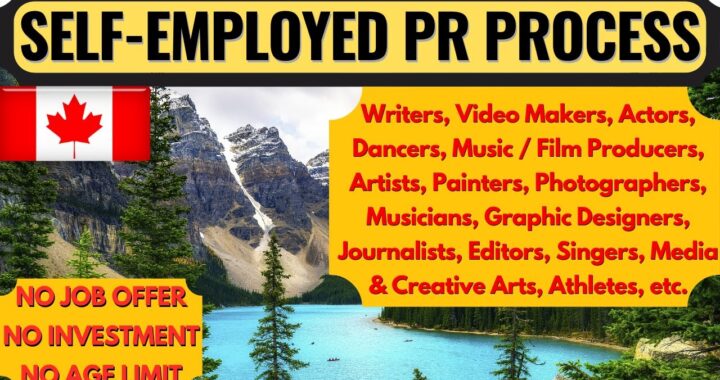

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?  Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs

Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs  Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries

Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries  Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination

Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination  H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand

H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes