Indian CAs stands a chance to practice in Canada- Find out How?

Indian CAs stands a chance to practice in Canada- Find out How?

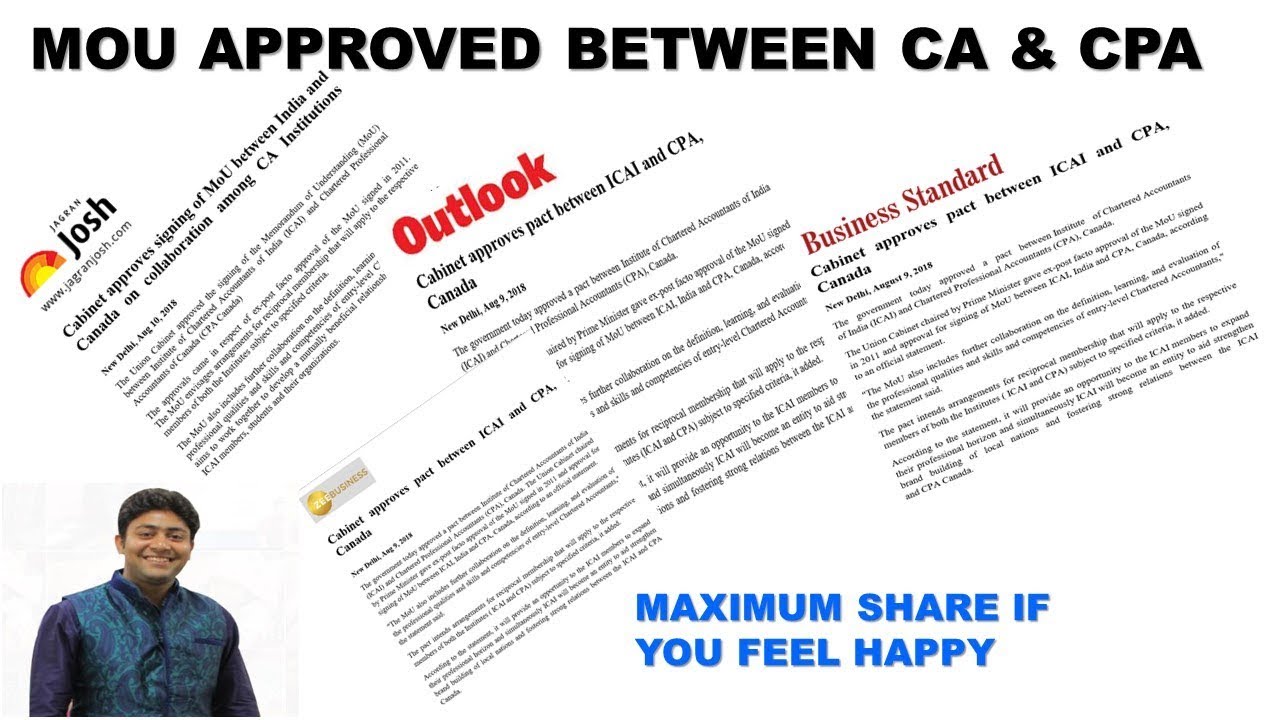

In Toronto last week, there held a meeting between the renowned Institutes for Chartered Accountants of countries India and Canada. In that meeting, both Institute of Chartered Accountants of India ( ICAI ) and Chartered Professional Accountants of Canada (CPA Canada) came to the conclusion of signing a MoU which will facilitate the CAs of both countries to practice and experience the Global market. With the help of bridging Mechanism, both the countries will acknowledge the talent of its members. This MoU makes a way for Indian CAs stands a chance to practice in Canada.

Indian CAs stands a chance to practice in Canada- Find out How?

The Institute of Chartered Accountants of India (ICAI)-

ICAI is an institute that comes into existence to maintain the regulation related to Accountancy in India. Department of Corporate Affairs in Indian Government handle the institute which compromises of 5 regional offices and with headquarter in New Delhi. ICAI regulates approximately 8 lakh of students and maintains the 2.90 lakh of its own members. Beside India ICAI too have branches overseas.

Favoring the agreement the President of ICAI CA. Naveen N D Gupta said that Canada is one of the destinations that allows a person to grow professionally providing global exposure. He further added that around 1000 CAs in India will get the chance to add extra skill and add a new dimension to Chartered Accountancy.

MoU will bring the skilled professional to the country and this will strengthen the innovation capacity of the country- Ms. Joy Thomas

President of CPA shares the similar views and expressing her views she added that this agreement is got for both the countries as this will help the integration of both the countries and skilled professional from India will help to strengthen innovation capacity of Canada.

Financial and Accountancy sectors to be in one of the 12 champion sectors as approved by the Indian Government-

Earlier this year in August, Prime Minister of India gave a green light to this agreement as Accountancy is one of the 12 champion sectors that need to be motivated. Since then, ICAI is putting its best foot forward to set a good repo which will ultimately lead to an agreement with foreign institutes of Accounting. These agreements will help to take the accountancy services overseas.

What will the MoU provide to the Indian CAs?

- Members of ICAI are exempt from requisites that are required for doing practical training under CPA Canada.

- Members of ICAI are exempt from exams such as CPA PEP and from the modules such as Capstone 1 or 2.

- Member of ICAI can clear the CPA Canada examination by giving only a final examination from the set of examination level.

Express Entry Updates for 2025: What Immigrants Need to Know

Express Entry Updates for 2025: What Immigrants Need to Know  Navigating Challenges: Canadian Cities, with High Crime Rate, moderate Job Opportunities, Where Immigrants May Struggle to Settle

Navigating Challenges: Canadian Cities, with High Crime Rate, moderate Job Opportunities, Where Immigrants May Struggle to Settle  The Shadowy Trade: Understanding Canadian “Coyotes” for Immigration and Protecting Yourself

The Shadowy Trade: Understanding Canadian “Coyotes” for Immigration and Protecting Yourself  Now Canada Can cancel the Travel Visa or Study Permit issued- What You Need to Know About Visa, Work, and Study Permit Cancellations

Now Canada Can cancel the Travel Visa or Study Permit issued- What You Need to Know About Visa, Work, and Study Permit Cancellations  Impact of Anti-Immigrant Sentiment on Canada’s Provinces and Job Sectors

Impact of Anti-Immigrant Sentiment on Canada’s Provinces and Job Sectors  Will You Be Deported for an Expired PR Card and having failed first test for Naturalization?

Will You Be Deported for an Expired PR Card and having failed first test for Naturalization?