Eligibility Criteria to get Employment Insurance in Canada

Employment Insurance or EI is a safety net that all the workers need to have. Paying premiums for employment insurance is one of the best things you can do in order to safeguard against future problems. There are eligibility criteria that decide who is eligible to receive benefits under the Employment Insurance Scheme.

The criterion for eligibility for Employment Insurance in Canada differs on the basis of two prime reasons namely:

- The area of a worker’s residence

- The benefits which are required by the applicant.

Here are the different criteria that govern the eligibility and benefits for Employment Insurance in Canada.

Employment Insurance Benefits in Canada and the Eligibility Criteria

Routine Employment Insurance benefits for salaried individuals include support from the program after losing the job. The amount of support differs from person to person depending on their weekly insurable income. To be eligible, people should:

- Have worked the minimum number of hours depending on the area of employment. The number of hours ranges from 420 up to 700 but it also relies on the unemployment rate.

- Be without income from the job for at least seven days.

- Have contributed to the insurance program.

However, people who have been fired for justifiable reasons and the people who quit without any good reason do not qualify for the benefits.

Special Employment Insurance Benefits Program for the Self Employed in Canada

Employment insurance in Canada for the Self Employed is a little complex but covers the special benefits, if required. Self Employed people who want Employment Insurance can get it by entering into an agreement with the CEIC. The Canada Employment Insurance Commission oversees the insurance program and they have different criterions for different benefits under the scheme. Eligibility requirements on a general basis include:

- Individuals need to have worked for at least 600 hours in the past 52 weeks or from the previous claim date to qualify.

- Self Employed people need to prove that there has been a loss of more than 40 percent in their weakly income.

There’s a 12 month waiting period before a claim can be made.

Maternity and Parental Benefits in Canada while in Job

Maternity benefits are provided to women who are expecting to give birth or have already given birth to a child. Parental benefits are provided to both men and women of a recently born or adopted child. A woman can qualify for both of these programs. Parents need to sign an affidavit regarding the date of birth or placement for adoption of the child. Parents are entitled to share the benefits as well. Parental benefits are given under normal and extended categories.

Sickness and Compassionate Care- while in Job in Canada

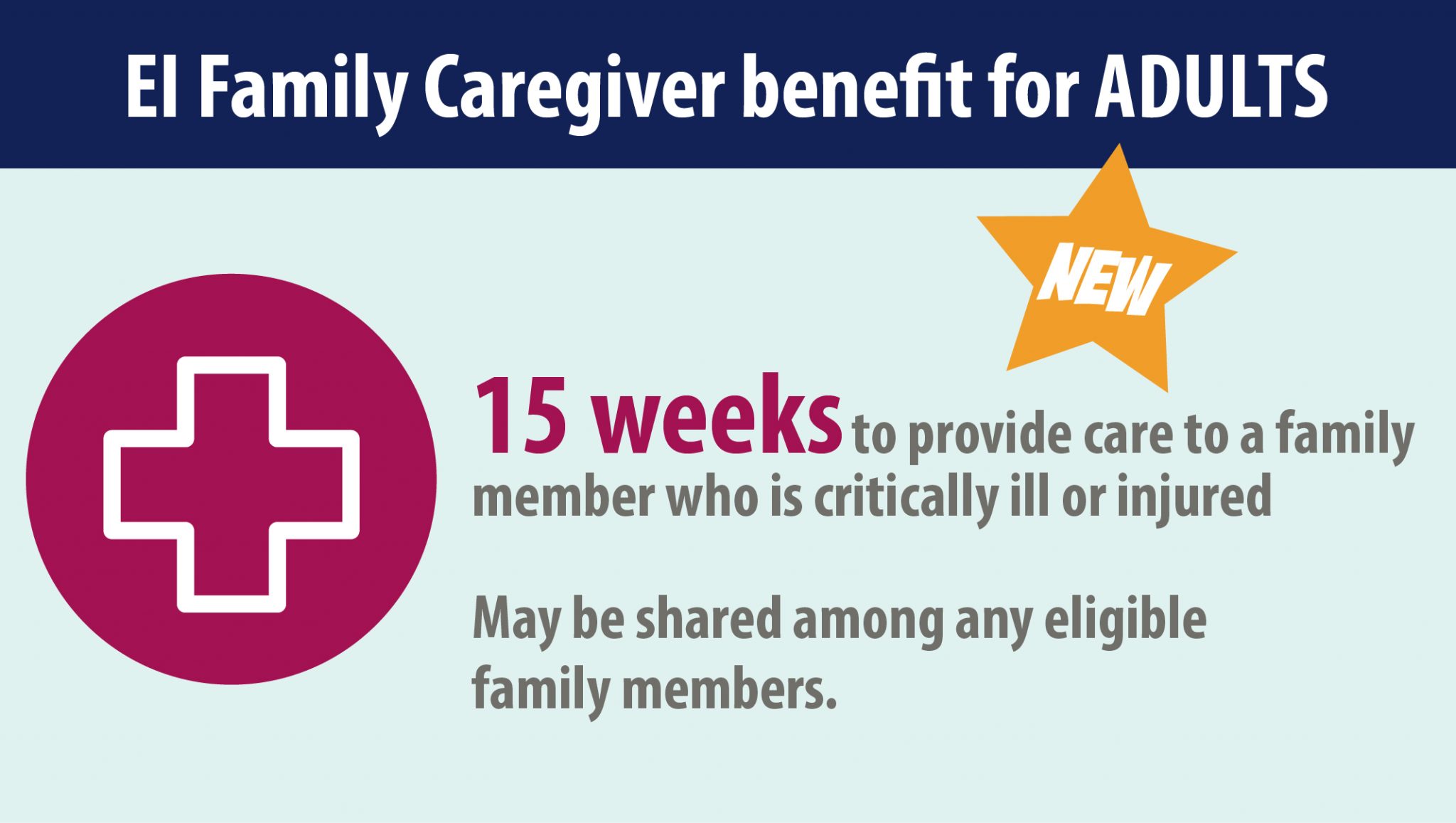

Sickness benefits are given for up to a 15 week period and Compassionate care benefits are given for up to a 26 week period. You need to prove your ability of work if not sick and the time period of sickness to be eligible. For compassionate care, the ill member must be from the eligible list of members and should be at a risk of dying in the next 26 weeks.

Calculation of Amount of Employment Insurance you will get in Canada

There’s no general estimate of the amount you get in the different categories as it is calculated on the basis of an individual’s income.

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?

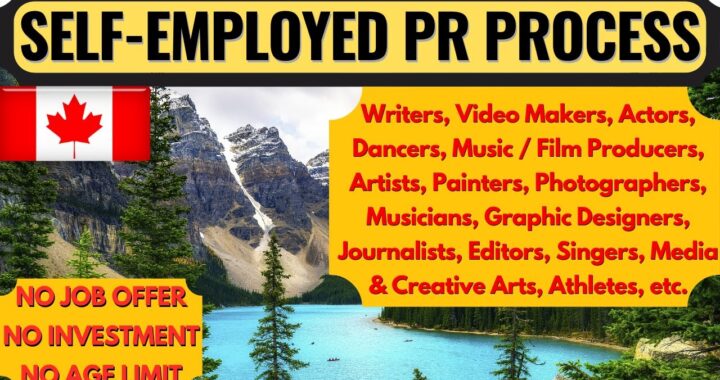

What actions by Trump Government are in store for illegal immigrants in US? What are Challenges to deport illegal immigrants from US?  What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?

What are changes in Canada Start up Visa Program and Self-Employed Persons Program. How would it affect the potential immigrants to Canada?  Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs

Launch Your Dreams: A Guide to Canada’s Start-Up Visa Program for Global Entrepreneurs  Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries

Options for Immigrating to Canada as a Healthcare Worker- Best Canadian Provinces that offer good salaries  Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination

Immigrating to Quebec province Canada- Professions in demand with salaries- Racial Discrimination  H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand

H1B Visa- Eligibility Requirements- its Duration- Process to apply and Professions in demand  Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India

Recent Changes to Canada’s Work Permit Rules and its impact on Immigrants from India  Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes

Applications for UK Immigration witness major decline as the Immigration Laws undergo significant changes